-

Employee Info Center

-

-

- Employee Portal (ESS)

- Employee Self-Service Portal Access

- Employee Social Security Number (SSN) Edits

- How do I disable pop-up blockers?

- How do I reset my web password?

- How does a new hire employee begin paperless onboarding ?

- I forgot my web username, can I reset it?

- Payroll & Benefits Onboarding for New Hires

- What is an Account Access Confirmation?

- Why can't I get my SECURITY CODE for Employee Self Service Account Access?

- Web Portals

- Account Security & Multi-Factor Authentication (MFA)

- Email Address Requirements

- Employee Handbooks

- Employee Support

- Employment & Salary Verifications

- How does a new hire employee begin paperless onboarding ?

- Payroll & Benefits Onboarding for New Hires

- Report a Workplace Concern

- What are your office hours?

- What is the status of my job application?

- Web Portals

-

-

- All Benefits & Perks

- AT&T Wireless Discounts

- Auto and Home Insurance (Save 15%)

- Corporate & Personal Travel Deals You Can't Find Anywhere Else

- FinFit - Personal Financial Tools for Employees

- MetLaw Legal Plans

- MetLife Aura Identity Theft Plans

- MetLife Pet Insurance

- Wages on Demand - Earned Wage Access

-

- All Benefits & Perks

- Understanding Your Employee Benefits

- Open Enrollment

- How To Save On Medical costs

- Benefit Basics Video

- Annual Plan Contribution Limits

- Qualifying Life Event (QLE)

- Who can I add as a dependent for my benefit coverage?

- Why isn't the benefit enrollment portal opening for me in the Employee Portal?

-

-

- Group & Voluntary Life Insurance Coverage for Dependents (MetLife)

- Group Dental Insurance (MetLife)

- Group Vision Insurance (MetLife)

- Voluntary Health: Physician, Urgent Care, Hospital, Dental, Vision, and Wellness Benefits, Inpatient, $0 Telemed (Hooray Health)

- WellCall360 - Voluntary Wellness + 0$ Tele-med, Rx, Dental, Vision (Hooray Health)

- Whole Life Insurance with Long-Term Care

-

- Voluntary Benefit Programs

- Short-term and Long-term Disability Insurance (MetLife)

- Group & Voluntary Life Insurance Coverage for Dependents (MetLife)

- Accident Insurance (MetLife)

- Critical Illness Insurance (MetLife)

- Hospital Indemnity Insurance (MetLife)

- Whole Life Insurance with Long-Term Care

- MetLaw Legal Plans

- MetLife Aura Identity Theft Plans

- MetLife Pet Insurance

- Voluntary Health: Physician, Urgent Care, Hospital, Dental, Vision, and Wellness Benefits, Inpatient, $0 Telemed (Hooray Health)

- WellCall360 - Voluntary Wellness + 0$ Tele-med, Rx, Dental, Vision (Hooray Health)

-

- Flex Spending Accounts

- How To Save On Medical costs

- Medical Expense FSA

- Premium Only Plan FSA

- Dependent Care FSA

- Annual Plan Contribution Limits

- Commuter, transit, and parking FSA

- Health Savings Accounts (HSA)

- Limited Purpose Flex Spending Account (LPFSA)

- FSA - Member Portal (year 2020 and previous)

-

Manager Info Center

-

- Employee Onboarding

- Workers Compensation Program and Policy Administration

- 401k Retirement Plan Services

- Document Management System (DMS)

- Leave Requests: PTO Tracking & Approvals

- Employment & Salary Verifications

- Corporate & Personal Travel Deals You Can't Find Anywhere Else

- Employee Earned Wage Access (EWA)

-

- Applicant Tracking System (ATS)

- Background and Drug Testing

- Labor Poster Compliance Solutions for Local and Remote Workers

- Business Insurance

- Employee Portal Messaging-Alerts

- Learning Management System (LMS)

- Performance Management (PM)

- R&D Tax Credit (R&D)

- Short-term Payroll Funding

- Work Opportunity Tax Credit (WOTC)

- Secure 2.0 for Employers

-

- Affordable Care Act (ACA) Compliance

- Employee Handbook Program (Core+)

- FMLA Compliance

- Full-Service Payroll & Employment Tax Administration

- HR Toolkit

- Labor Poster Compliance Solutions for Local and Remote Workers

- Onboarding Your New Hire onto the Payroll System

- Time Keeping Solutions Introduction

- Workers Compensation Program and Policy Administration

- Workplace Safety Program Assistance

-

- Full-Service Payroll & Employment Tax Administration

- Office Schedule, Payroll Processing Cutoff Dates, Federal Reserve Bank Holidays, System Maintenance Schedule

- Direct Deposit

- Employee Earned Wage Access (EWA)

- Employment & Salary Verifications

- Minimum Wage Map

- Payroll Timesheet Imports

- Payroll VISA Paycard (employer)

- Submitting Payroll Hours, Salary, Commissions, etc.

-

- Employee Onboarding

- How does a new hire employee begin paperless onboarding ?

- Onboarding Your New Hire onto the Payroll System

- Payroll & Benefits Onboarding for New Hires

- How do I process the paperless I-9?

- Background and Drug Testing

- Employee Termination Processing

- I-9 Part 2 Approval Guide

- Unemployment Processing

- RE-HIRES

-

- All Benefits & Perks

- 401k Retirement Plan Services

- Affordable Care Act (ACA) Compliance

- Employee Assistance, Wellness, and Lifestyle Programs (EAP)

- Employee Benefit Plan Administration

- FinFit - Financial EAP

- Flex Spending Accounts

- Group & Voluntary Life Insurance Coverage for Dependents (MetLife)

- Voluntary Benefit Programs

-

-

- Workers Compensation Program and Policy Administration

- Claims Management and Administration Assistance

- Employment Practice Liability Insurance (EPLI)

- Workplace Safety Program Assistance

- Business Insurance

- Report a Workplace Concern

- Report a Workplace Injury

- Secure Upload Documents

- WC CLAIMS FORMS BY STATE

-

- Document Management System (DMS)

- Employee Portal Event Management

- Employee Portal Messaging-Alerts

- Employee Record Maintenance in the Manager Portal

- Employee Social Security Number (SSN) Edits

- I-9 Part 2 Approval Guide

- Training Support in the Manager Portal

- Training Tutorials and Demonstrations - Worksite Managers and Administrators

- Technical Product Support Requests

A Qualifying Life Event (QLE) is a change in situation (such as getting married or divorced, a change in residence, or a job loss) that makes a person eligible to enroll in health insurance outside the yearly Open Enrollment Period.

What Is a Qualifying Life Event for Health Insurance?

A Qualifying Event for health insurance purposes is a major event that affects a person’s health insurance needs and qualifies that person to make changes or buy a health plan immediately, even if it occurs outside of open enrollment dates.

Generally, Special Enrollment lasts 30 days before or after the qualifying event, allowing an individual to make plan changes or sign up for new coverage immediately.

What Is a Qualifying Life Event?

A Qualifying Life Event is an event that makes someone eligible for a health insurance Special Enrollment Period rather than waiting for an Open Enrollment Period.

There are four categories of qualifying life events:

- Loss of health insurance

- Changes in household

- Changes in residence

- Other qualifying changes

Loss of Health Insurance

- Turning 26 years old and losing coverage through a parent’s insurance plan

- Losing job-based coverage, COBRA, or a student plan

- Losing eligibility for Medicare, Medicaid, or the Children’s Health Insurance Program (CHIP)

- Losing health insurance for any reason other than not paying the premiums

Changes in Household

- Getting married, separated, or divorced

- Having a baby, adopting a child, or receiving a foster child

- The death of someone on your health insurance policy

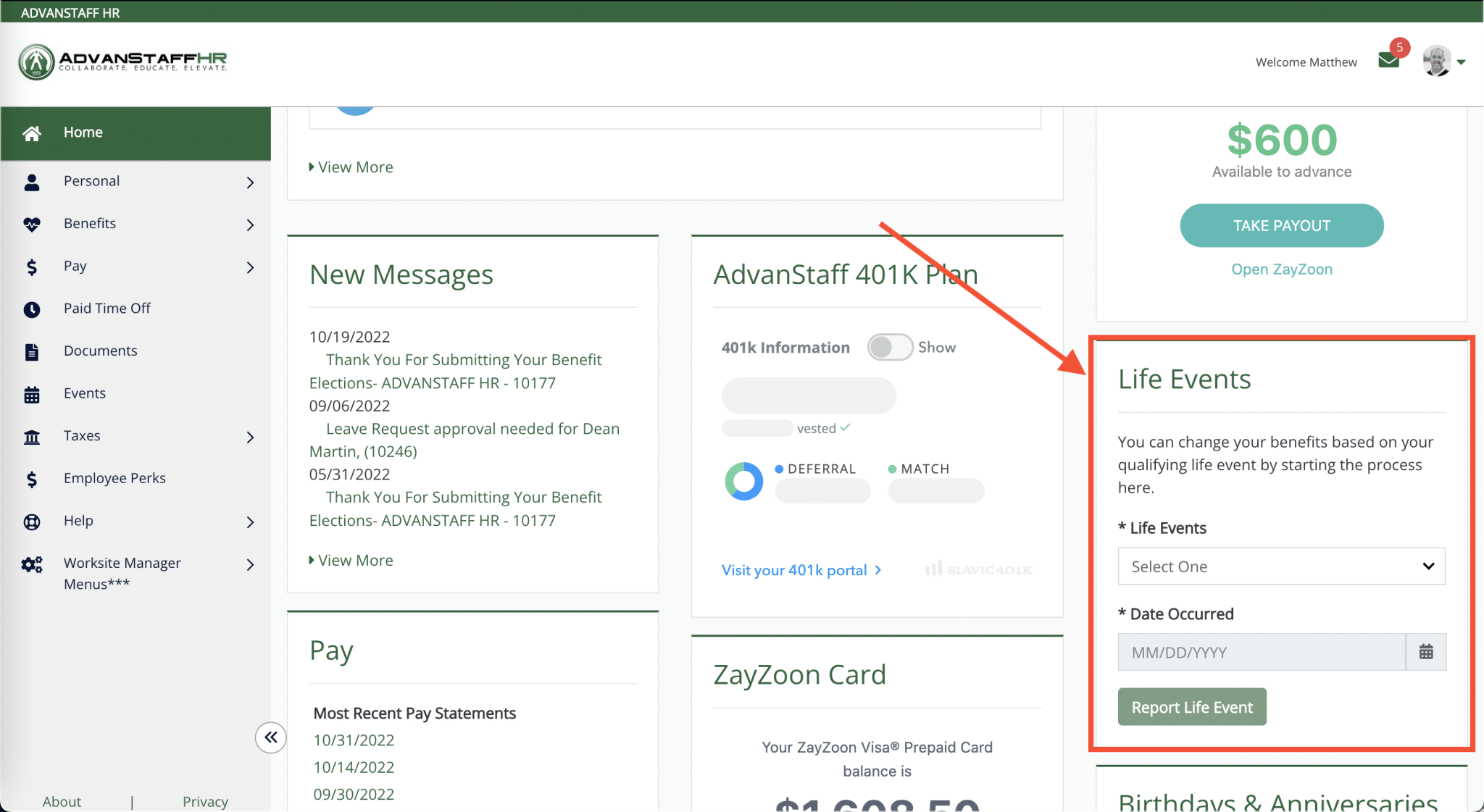

How do I report a Qualified Life Event?

You can report a Qualified Life Event directly in the Employee Portal. The Advanstaff Employee Benefits Department may contact you for additional documentation as the carrier requires.

To get started

- Log in to the Employee Portal

- Locate the “Life Events” tile on the default dashboard

- Follow the instructions