-

Employee Info Center

-

-

- Employee Portal (ESS)

- Employee Self-Service Portal Access

- Employee Social Security Number (SSN) Edits

- How do I disable pop-up blockers?

- How do I reset my web password?

- How does a new hire employee begin paperless onboarding ?

- I forgot my web username, can I reset it?

- Payroll & Benefits Onboarding for New Hires

- What is an Account Access Confirmation?

- Why can't I get my SECURITY CODE for Employee Self Service Account Access?

- Web Portals

- Account Security & Multi-Factor Authentication (MFA)

- Email Address Requirements

- Employee Handbooks

- Employee Support

- Employment & Salary Verifications

- How does a new hire employee begin paperless onboarding ?

- Payroll & Benefits Onboarding for New Hires

- Report a Workplace Concern

- What are your office hours?

- What is the status of my job application?

- Web Portals

-

-

- All Benefits & Perks

- AT&T Wireless Discounts

- Auto and Home Insurance (Save 15%)

- Corporate & Personal Travel Deals You Can't Find Anywhere Else

- FinFit - Personal Financial Tools for Employees

- MetLaw Legal Plans

- MetLife Aura Identity Theft Plans

- MetLife Pet Insurance

- Wages on Demand - Earned Wage Access

-

- All Benefits & Perks

- Understanding Your Employee Benefits

- Open Enrollment

- How To Save On Medical costs

- Benefit Basics Video

- Annual Plan Contribution Limits

- Qualifying Life Event (QLE)

- Who can I add as a dependent for my benefit coverage?

- Why isn't the benefit enrollment portal opening for me in the Employee Portal?

-

-

- Group & Voluntary Life Insurance Coverage for Dependents (MetLife)

- Group Dental Insurance (MetLife)

- Group Vision Insurance (MetLife)

- Voluntary Health: Physician, Urgent Care, Hospital, Dental, Vision, and Wellness Benefits, Inpatient, $0 Telemed (Hooray Health)

- WellCall360 - Voluntary Wellness + 0$ Tele-med, Rx, Dental, Vision (Hooray Health)

- Whole Life Insurance with Long-Term Care

-

- Voluntary Benefit Programs

- Short-term and Long-term Disability Insurance (MetLife)

- Group & Voluntary Life Insurance Coverage for Dependents (MetLife)

- Accident Insurance (MetLife)

- Critical Illness Insurance (MetLife)

- Hospital Indemnity Insurance (MetLife)

- Whole Life Insurance with Long-Term Care

- MetLaw Legal Plans

- MetLife Aura Identity Theft Plans

- MetLife Pet Insurance

- Voluntary Health: Physician, Urgent Care, Hospital, Dental, Vision, and Wellness Benefits, Inpatient, $0 Telemed (Hooray Health)

- WellCall360 - Voluntary Wellness + 0$ Tele-med, Rx, Dental, Vision (Hooray Health)

-

- Flex Spending Accounts

- How To Save On Medical costs

- Medical Expense FSA

- Premium Only Plan FSA

- Dependent Care FSA

- Annual Plan Contribution Limits

- Commuter, transit, and parking FSA

- Health Savings Accounts (HSA)

- Limited Purpose Flex Spending Account (LPFSA)

- FSA - Member Portal (year 2020 and previous)

-

Manager Info Center

-

- Employee Onboarding

- Workers Compensation Program and Policy Administration

- 401k Retirement Plan Services

- Document Management System (DMS)

- Leave Requests: PTO Tracking & Approvals

- Employment & Salary Verifications

- Corporate & Personal Travel Deals You Can't Find Anywhere Else

- Employee Earned Wage Access (EWA)

-

- Applicant Tracking System (ATS)

- Background and Drug Testing

- Labor Poster Compliance Solutions for Local and Remote Workers

- Business Insurance

- Employee Portal Messaging-Alerts

- Learning Management System (LMS)

- Performance Management (PM)

- R&D Tax Credit (R&D)

- Short-term Payroll Funding

- Work Opportunity Tax Credit (WOTC)

- Secure 2.0 for Employers

-

- Affordable Care Act (ACA) Compliance

- Employee Handbook Program (Core+)

- FMLA Compliance

- Full-Service Payroll & Employment Tax Administration

- HR Toolkit

- Labor Poster Compliance Solutions for Local and Remote Workers

- Onboarding Your New Hire onto the Payroll System

- Time Keeping Solutions Introduction

- Workers Compensation Program and Policy Administration

- Workplace Safety Program Assistance

-

- Full-Service Payroll & Employment Tax Administration

- Office Schedule, Payroll Processing Cutoff Dates, Federal Reserve Bank Holidays, System Maintenance Schedule

- Direct Deposit

- Employee Earned Wage Access (EWA)

- Employment & Salary Verifications

- Minimum Wage Map

- Payroll Timesheet Imports

- Payroll VISA Paycard (employer)

- Submitting Payroll Hours, Salary, Commissions, etc.

-

- Employee Onboarding

- How does a new hire employee begin paperless onboarding ?

- Onboarding Your New Hire onto the Payroll System

- Payroll & Benefits Onboarding for New Hires

- How do I process the paperless I-9?

- Background and Drug Testing

- Employee Termination Processing

- I-9 Part 2 Approval Guide

- Unemployment Processing

- RE-HIRES

-

- All Benefits & Perks

- 401k Retirement Plan Services

- Affordable Care Act (ACA) Compliance

- Employee Assistance, Wellness, and Lifestyle Programs (EAP)

- Employee Benefit Plan Administration

- FinFit - Financial EAP

- Flex Spending Accounts

- Group & Voluntary Life Insurance Coverage for Dependents (MetLife)

- Voluntary Benefit Programs

-

-

- Workers Compensation Program and Policy Administration

- Claims Management and Administration Assistance

- Employment Practice Liability Insurance (EPLI)

- Workplace Safety Program Assistance

- Business Insurance

- Report a Workplace Concern

- Report a Workplace Injury

- Secure Upload Documents

- WC CLAIMS FORMS BY STATE

-

- Document Management System (DMS)

- Employee Portal Event Management

- Employee Portal Messaging-Alerts

- Employee Record Maintenance in the Manager Portal

- Employee Social Security Number (SSN) Edits

- I-9 Part 2 Approval Guide

- Training Support in the Manager Portal

- Training Tutorials and Demonstrations - Worksite Managers and Administrators

- Technical Product Support Requests

Attention!

Starting with the 2022 Plan year, FSA and Transportation participants are allowed to rollover unused funds from year to year according to IRS limits. View plan limits HERE.

Flex-Spending Accounts

Save money on every paycheck by reducing taxes through covered expenses

Types of Flex Spending Accounts Available

AdvanStaff offers many types of FSA accounts so employees can lower taxes and take home as much money as possible.

The FSA plan types are as follows:

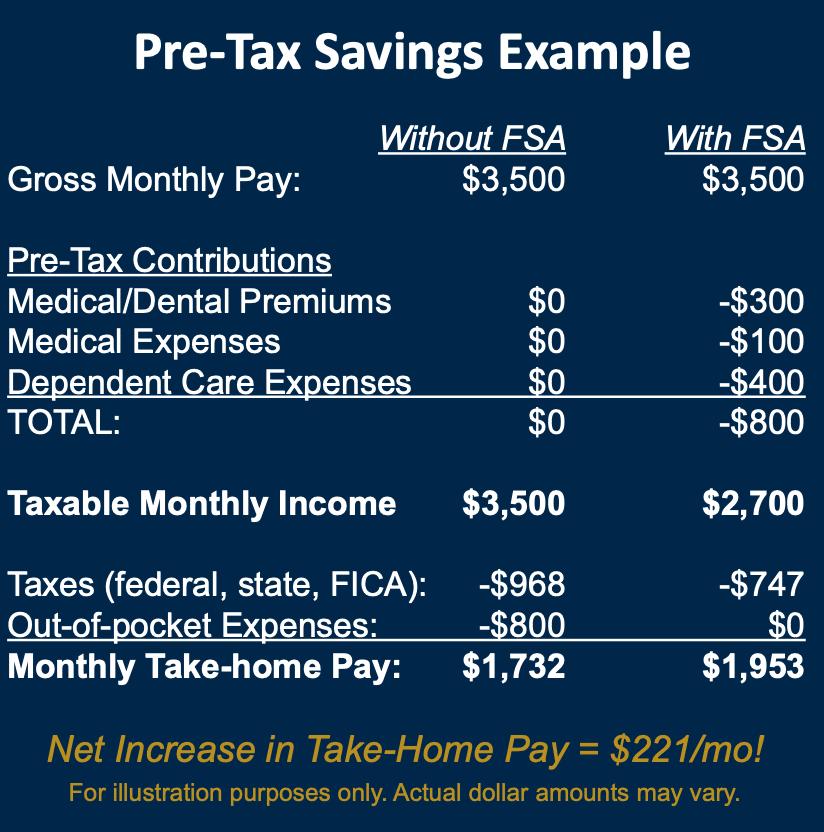

Increase Your Take-Home Pay by Reducing Your Taxable Income!

A Flexible Spending Account (FSA) allows you to save up to 30% on eligible healthcare, dependent care, business parking, and commuting expenses every year using pre-tax dollars.

Consider how much you spend each year on the following:

- payroll-deducted premiums for qualified employer benefit programs

- prescription drugs/medications/vaccinations

- medical/dental office visits

- eye exams and prescription glasses/lenses

- daycare tuition

- Business parking and commuting

Why not reduce these expenses by using pre-tax dollars instead of after-tax dollars?

With rising healthcare costs, every penny counts! By using pre-tax dollars, you are taxed on a lower gross salary, thereby saving money that would otherwise be spent on federal, state, and FICA taxes, and so you increase your take-home pay!

FSA Frequently Asked Questions

The FSA is offered through your employer and administered by AdvanStaff HR. When you enroll in FSA plan, you decide the dollar amount you want to contribute to each account based on your estimated expenses for the upcoming year. The funds will be deducted pre-tax in equal amounts from each paycheck throughout the plan year. For every dollar you put into these accounts, you save more by paying less in taxes.

As you incur eligible expenses, you use the supplied VISA to pay the service or product provider directly up to the amount of your annual contribution.

If you decide to or can’t use the provided card for direct pay, you may also elect to receive reimbursement directly in your bank account.

You can access your account from within the Employee Portal.

Login to the Employee Portal -> Benefits -> Flex Spending (OMEGA FSA)

When can I enroll?

You can enroll upon being hired by your employer or annually during open enrollment, which is generally Nov 1 – 30 for the following plan year.

Accessing the pre-tax funds in our account is easy. Shortly after enrolling, present the Visa pay card given to you by AdvanStaff HR. You can directly pay any vendor that accepts card payments. No reimbursement is required.

You can also upload paid receipts via the employee portal, and we will deposit the funds directly into your bank account.

Use the AdvanStaff HR Employee portal to do the following:

- View the account and check the balance

- Make an HSA contribution or distribution

- Enter and track expenses

- Make a payment from your account

- file FSA/HRA claims with receipt images

- Scan or view eligible costs and more!

At the time of enrollment or during annual open enrollment, you are eligible to make an annual election on how much to save from each paycheck.

AdvanStaff will deduct those equal amounts each pay period BEFORE taxes are paid, so you won’t be paying taxes on the amounts. We will then deposit the amounts into a special account linked to a VISA debit card for you to conveniently use for covered expenses.

Health Savings Accounts (HSAs) are generally funded by the employer and/or the employee.

- Understand the IRS contribution limits

for your Plan during the Plan year (available at the online enrollment site). - Review the eligible and ineligible expense lists for Healthcare FSA and Dependent Care FSA.

- Determine which eligible expenses you expect to incur during the Plan year and how much you will spend.

- The amount you project to be spent on eligible healthcare and/or dependent care expenses during the Plan year is the amount you should contribute to your FSA.

FSA Funds Rollover:

Starting in 2022, the AdvanStaff FSA plan allows the maximum IRS limit to rollover funds from one year to the next.

The plan year is one full year (365 days) and generally begins on the first of a month. The AdvanStaff HR plan runs for an entire calendar year, from January 1 to December 31.

The grace period is 90 days (up until March 31st of the following year) which employees may use up any funds remaining at the end of the plan year. For FSA and Transportation Accounts, the unused funds will be rolled over to the following plan year according to IRS determined limits.

Deadlines:

Allowable expenses must be incurred from January 1 – December 31.

All reimbursements must be claimed no later than March 31 for the previous plan year.

This rule states that any funds remaining in the participating employee’s FSA account at the plan year’s end will be forfeited to the employer. Although the rule is clear, many users of an FSA largely misunderstand the result of the rule: loss of funds can be easily avoided.

Let’s look at an example:

Joe Smith participates in the Medical FSA and elects to fund $500 annually. After the plan year and grace period are complete, Joe finds that he spent only $400 of the original $500 he put away. He fears he has lost $100, but due to the taxes he saved on the $500 he has not. Let’s say Joe is in the 28% tax bracket. By putting $500 away in his Medical FSA, he saved $140 in taxes (money not taken out of his paycheck and given to the IRS). In sum, even if Joe leaves $100 in his Medical FSA account, he still saves $40! This vital key issue must be explained completely to potential FSA participants.

Employees who participate in an FSA should determine the amount to fund by examining their expenses for the year; this amount is not arbitrary.

In this example, Mary Johnson is married with two children. One child is in daycare, Mary has glasses, and her husband, Tom, has allergies. When adding up how much to put away in her Medical and Dependent Care FSA accounts, Mary looks ahead for the year and determines that one child is going to need braces (add $2,000), that Mary is going to need glasses (add $500), and that Tom has a regular prescription for allergy medicine every month (add $120: $10 per month co-pay). Adding it all up, she determines her expenses add up to $5,000 for daycare and $2,620 for medical expenses. Since the limit on the medical FSA for 2022 is $2,850, Mary will elect $2,850 for the Medical FSA and $5,000 for the Dependent Care FSA. The total amount she will put away toward her FSA is $7,850. These are expenses she knows will be incurred. Once again, at an average 28% tax bracket, Mary will save $2,270 by using her FSA! That is equivalent to getting her child’s braces for free! She does not doubt that she should take advantage of her FSA and save this money.

Cafeteria Plans are qualified, non-discriminatory benefit plans, meaning a discrimination test must be met based on the participants’ elections combined with the employer’s contribution.

You may change your FSA elections during the Plan year only if you experience a change of status, such as:

- a marriage or divorce

- birth or adoption of a child, or

- a change in employment status

For a complete list of circumstances acceptable for changing elections mid-year, refer to the Change of Election Form (available from your employer).