-

Employee Info Center

-

-

- Employee Portal (ESS)

- Employee Self-Service Portal Access

- Employee Social Security Number (SSN) Edits

- How do I disable pop-up blockers?

- How do I reset my web password?

- How does a new hire employee begin paperless onboarding ?

- I forgot my web username, can I reset it?

- Payroll & Benefits Onboarding for New Hires

- What is an Account Access Confirmation?

- Why can't I get my SECURITY CODE for Employee Self Service Account Access?

- Web Portals

- Account Security & Multi-Factor Authentication (MFA)

- Email Address Requirements

- Employee Handbooks

- Employee Support

- Employment & Salary Verifications

- How does a new hire employee begin paperless onboarding ?

- Payroll & Benefits Onboarding for New Hires

- Report a Workplace Concern

- What are your office hours?

- What is the status of my job application?

- Web Portals

-

-

- All Benefits & Perks

- AT&T Wireless Discounts

- Auto and Home Insurance (Save 15%)

- Corporate & Personal Travel Deals You Can't Find Anywhere Else

- FinFit - Personal Financial Tools for Employees

- MetLaw Legal Plans

- MetLife Aura Identity Theft Plans

- MetLife Pet Insurance

- Wages on Demand - Earned Wage Access

-

- All Benefits & Perks

- Understanding Your Employee Benefits

- Open Enrollment

- How To Save On Medical costs

- Benefit Basics Video

- Annual Plan Contribution Limits

- Qualifying Life Event (QLE)

- Who can I add as a dependent for my benefit coverage?

- Why isn't the benefit enrollment portal opening for me in the Employee Portal?

-

-

- Group & Voluntary Life Insurance Coverage for Dependents (MetLife)

- Group Dental Insurance (MetLife)

- Group Vision Insurance (MetLife)

- Voluntary Health: Physician, Urgent Care, Hospital, Dental, Vision, and Wellness Benefits, Inpatient, $0 Telemed (Hooray Health)

- WellCall360 - Voluntary Wellness + 0$ Tele-med, Rx, Dental, Vision (Hooray Health)

- Whole Life Insurance with Long-Term Care

-

- Voluntary Benefit Programs

- Short-term and Long-term Disability Insurance (MetLife)

- Group & Voluntary Life Insurance Coverage for Dependents (MetLife)

- Accident Insurance (MetLife)

- Critical Illness Insurance (MetLife)

- Hospital Indemnity Insurance (MetLife)

- Whole Life Insurance with Long-Term Care

- MetLaw Legal Plans

- MetLife Aura Identity Theft Plans

- MetLife Pet Insurance

- Voluntary Health: Physician, Urgent Care, Hospital, Dental, Vision, and Wellness Benefits, Inpatient, $0 Telemed (Hooray Health)

- WellCall360 - Voluntary Wellness + 0$ Tele-med, Rx, Dental, Vision (Hooray Health)

-

- Flex Spending Accounts

- How To Save On Medical costs

- Medical Expense FSA

- Premium Only Plan FSA

- Dependent Care FSA

- Annual Plan Contribution Limits

- Commuter, transit, and parking FSA

- Health Savings Accounts (HSA)

- Limited Purpose Flex Spending Account (LPFSA)

- FSA - Member Portal (year 2020 and previous)

-

Manager Info Center

-

- Employee Onboarding

- Workers Compensation Program and Policy Administration

- 401k Retirement Plan Services

- Document Management System (DMS)

- Leave Requests: PTO Tracking & Approvals

- Employment & Salary Verifications

- Corporate & Personal Travel Deals You Can't Find Anywhere Else

- Employee Earned Wage Access (EWA)

-

- Applicant Tracking System (ATS)

- Background and Drug Testing

- Labor Poster Compliance Solutions for Local and Remote Workers

- Business Insurance

- Employee Portal Messaging-Alerts

- Learning Management System (LMS)

- Performance Management (PM)

- R&D Tax Credit (R&D)

- Short-term Payroll Funding

- Work Opportunity Tax Credit (WOTC)

- Secure 2.0 for Employers

-

- Affordable Care Act (ACA) Compliance

- Employee Handbook Program (Core+)

- FMLA Compliance

- Full-Service Payroll & Employment Tax Administration

- HR Toolkit

- Labor Poster Compliance Solutions for Local and Remote Workers

- Onboarding Your New Hire onto the Payroll System

- Time Keeping Solutions Introduction

- Workers Compensation Program and Policy Administration

- Workplace Safety Program Assistance

-

- Full-Service Payroll & Employment Tax Administration

- Office Schedule, Payroll Processing Cutoff Dates, Federal Reserve Bank Holidays, System Maintenance Schedule

- Direct Deposit

- Employee Earned Wage Access (EWA)

- Employment & Salary Verifications

- Minimum Wage Map

- Payroll Timesheet Imports

- Payroll VISA Paycard (employer)

- Submitting Payroll Hours, Salary, Commissions, etc.

-

- Employee Onboarding

- How does a new hire employee begin paperless onboarding ?

- Onboarding Your New Hire onto the Payroll System

- Payroll & Benefits Onboarding for New Hires

- How do I process the paperless I-9?

- Background and Drug Testing

- Employee Termination Processing

- I-9 Part 2 Approval Guide

- Unemployment Processing

- RE-HIRES

-

- All Benefits & Perks

- 401k Retirement Plan Services

- Affordable Care Act (ACA) Compliance

- Employee Assistance, Wellness, and Lifestyle Programs (EAP)

- Employee Benefit Plan Administration

- FinFit - Financial EAP

- Flex Spending Accounts

- Group & Voluntary Life Insurance Coverage for Dependents (MetLife)

- Voluntary Benefit Programs

-

-

- Workers Compensation Program and Policy Administration

- Claims Management and Administration Assistance

- Employment Practice Liability Insurance (EPLI)

- Workplace Safety Program Assistance

- Business Insurance

- Report a Workplace Concern

- Report a Workplace Injury

- Secure Upload Documents

- WC CLAIMS FORMS BY STATE

-

- Document Management System (DMS)

- Employee Portal Event Management

- Employee Portal Messaging-Alerts

- Employee Record Maintenance in the Manager Portal

- Employee Social Security Number (SSN) Edits

- I-9 Part 2 Approval Guide

- Training Support in the Manager Portal

- Training Tutorials and Demonstrations - Worksite Managers and Administrators

- Technical Product Support Requests

401k Retirement Savings

w/ Slavic401k

It’s time for you to take responsibility for your future.

After all, if you don’t, who will?

Pay Yourself Before Uncle Sam.

Let’s face it. Relying on Social Security to sustain you during retirement is no longer viable. Today’s workers must take ownership of their financial futures by investing in a 401(k) plan.

Plan Participant Resources & Tools

A 401(k) plan is an EXCELLENT way to save for retirement. Following are a few additional benefits of a 401(k) program:

- Employer matching contributions. When you save using a 401(k) your employer may also contribute to your plan. This is FREE money boosting an immediate gain in your account balance.

- Tax-deferred growth. Funds in your employers 401(k) plan grow tax-deferred meaning you wont pay taxes until you withdraw amounts during retirement.

- Automatic savings. At your direction, AdvanStaff HR will deduct the amount you elect to save directly from your paycheck and we will remit the deposit to be invested according to your investment sections.

- Taxable advantages. Traditional 401(k) contributions are taken out of your paycheck before taxes are deducted from your paycheck. That means gross income is reduced, so you pay less in income taxes. Roth 401(k) contributions are post-tax deductions, meaning taxable income is NOT reduced. However, Roth balances are not taxed at the time of distribution during retirement.

Investing as little as the cost of going out to eat once every paycheck can result in a very healthy 401(k) account balance over a few decades.

Frequently Asked Questions

How to Enroll

Notification

Employees will receive an eligibility notice by mail several weeks before enrolling in the 401k program. They can enroll anytime, but deductions will not start until the proper entry date occurs.

Entry Date

The 401k program’s entry date varies by plan but is generally the first day of the month or the first day of each quarter (Jan 1, April 1, July 1, Oct 1). Enrollment, either online (recommended) or via a paper packet, must be completed BEFORE the entry date.

We offer two options to enroll.

Option 1 – Enrolling in the Portal

To start, log in to the Employee Portal.

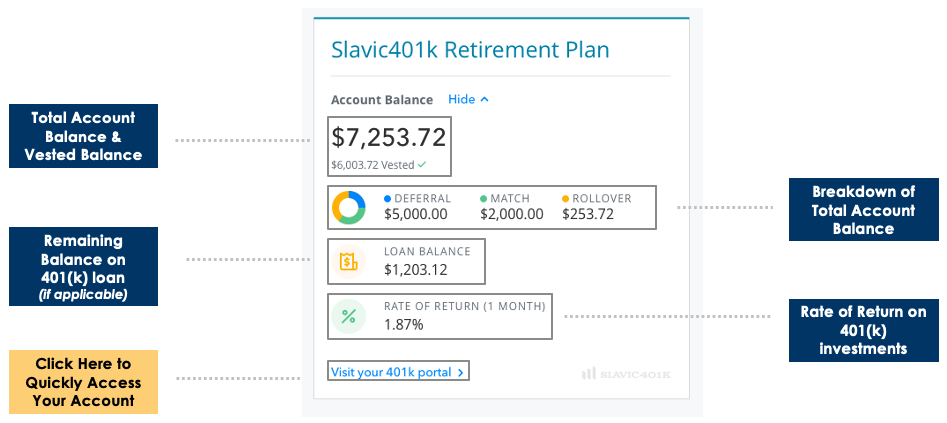

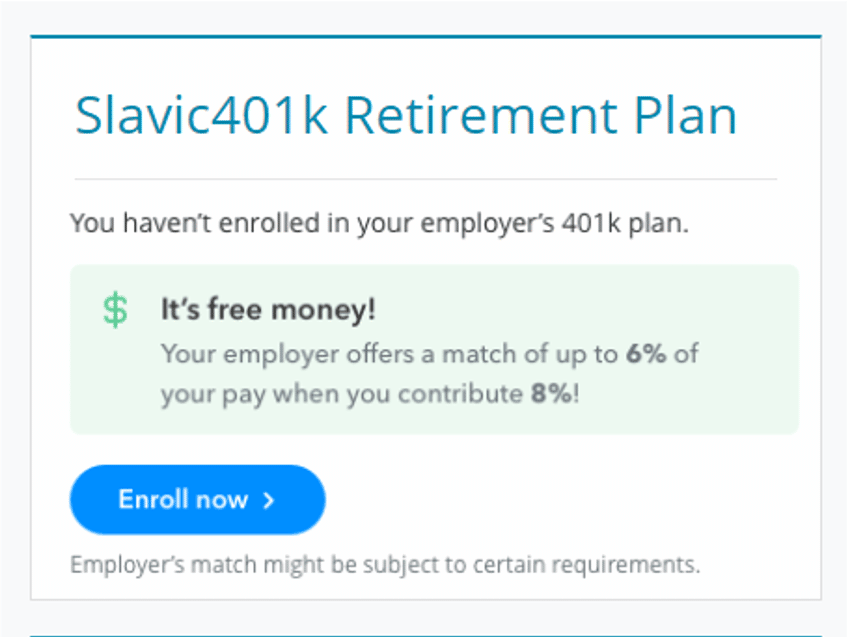

If your worksite employer offers a 401k plan, you will see a 401k tile on your employee portal dashboard that looks like this:

If you are eligible but not participating:

If you are already participating:

Click on the “Enroll Now” button to get started.

Once you are logged in to your private account, you can:

- elect your contributions

- decide if you want to participate in a traditional 401k or Roth 401k

- choose your investments (consider Bespoke services)

- designate your beneficiaries

- finalize your enrollment

The entire process is paperless, simple, and fast!

Option 2- Enroll Directly via the Slavic Website

You can also enroll via the Slavic401k.com website.

We have an enrollment guide below. Clicking on the dashboard widget link inside the AdvanStaff HR employee portal eliminates many steps.

How do I log into my account?

Accessing your account couldn’t be any easier.

Option 1 – Accessing your account via the AdvanStaff HR Portal

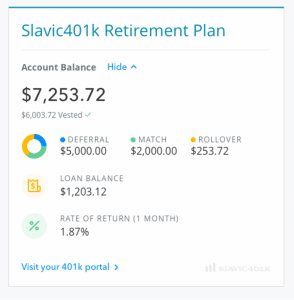

Log into the Employee Portal and look for the 401k dashboard tile. It should look something like this:

Click on the “Visit your 401k portal” link to automatically take you to your 401k account.

The portal allows you account access 24 x 7 to:

- Make instant adjustments to your 401(k) plan

- Track your investment in real-time

- Manage any aspect of your 401(k) account

- and much, much more!

Option 2 – Accessing your account directly with Slavic 401k

If you don’t have access to the employee portal, you can also log in to the Slavic 401k website directly.

Limit change from year to year. You can view all tax-advantage plan limits here:

Traditional vs. Roth: What’s the Difference?

In addition to a traditional 401(k), your employer has added the Roth 401(k) deferral option to your retirement plan.

In a traditional 401(k) plan, contributions are made with before-tax dollars. The money is not taxed while it remains in your account, but every dollar taken out is taxed as ordinary income. Contributions to a Roth 401(k) are made with after-tax dollars, so initially, they won’t reduce your tax bill. However, the money will grow tax-free, and all withdrawals after age 59 1/2 will be tax-free. In other words, a regular 401(k) plan gives you a tax break on the front end, while the Roth 401(k) gives it to you on the back end.

Which is Right for You?

There is no one-size-fits-all answer. Instead, the correct answer for you will depend on your current tax situation and whether your tax rate will likely be higher or lower in retirement.

Since you don’t pay any taxes on Roth withdrawals, the higher your tax bracket in retirement, the more advantageous a Roth is likely to be. Strong savers—including those who contribute the maximum amount allowed by the IRS each year—are good Roth candidates because they are likely to have a bigger nest egg in retirement that can benefit from Roth’s tax-free withdrawals.

On the other hand, if you’re in a low tax bracket today, you might consider a Roth now, when lowering your gross income will not be as significant a tax benefit as it might be later on if you find yourself in a higher bracket.

Because it comes right out of your paycheck, a Roth contribution is likely to reduce your take-home pay by more than a similar contribution to a traditional 401(k) made using pre-tax dollars. If you want to save—and take home as much money as possible—a traditional 401(k) is perhaps the way to go.

Finally, since no one knows what tax rates will be, diversifying with contributions to a traditional 401(k) and Roth might be a way to hedge your tax bets with your retirement savings.

There are many variables to consider when deciding if a Roth 401k is right for you. We recommend you speak to your tax accountant or financial professional to help determine if the Roth is appropriate for your circumstances.

You may contribute to one or both accounts, but you may not double your contribution by having both 401(k) accounts. The same contribution limit will apply to either account or both combined. If your employer provides a matching contribution, the match must be put into the traditional 401(k) account — subject to the regular 401(k) rules — even if you are directing all of your contributions into a Roth 401(k). Loans are not available in the Roth 401(k).

Investment Options

Participants have access to:

- Over 60 fund options,

- Ten target-date portfolio choices,

- Fund investment companies like Vanguard, Janus, Fidelity, Invesco, American Funds, Wells Fargo, and T. Rowe Price,

- Managed accounts through the “Bespoke” platform based on your risk tolerance and investment preferences.

The Bespoke Portfolio Service is a proprietary algorithm developed by Slavic401k. Bespoke is one of the first digital advisors built into a 401(k) platform.

Self-Directed Brokerage Accounts (SDBA)

The 401k program is built on the Fidelity investment platform.

Employees can also use a fully self-directed brokerage account through Fidelity to invest in stocks, bonds, and other investment vehicles. Margin trading is not supported.

To enroll, please visit Slavic401k customer service on their website or call a specialist at (800) 356-3009.

Slavic’s Bespoke Portfolio Service was carefully crafted with the participant-investor in mind. Bespoke allows you to lean on Slavic’s decades of technology and 401(k) investment expertise to put your money to work for you, no matter your life stage.

Learn more about the powerful advantages of Slavic’s proprietary Bespoke Portfolio Service.

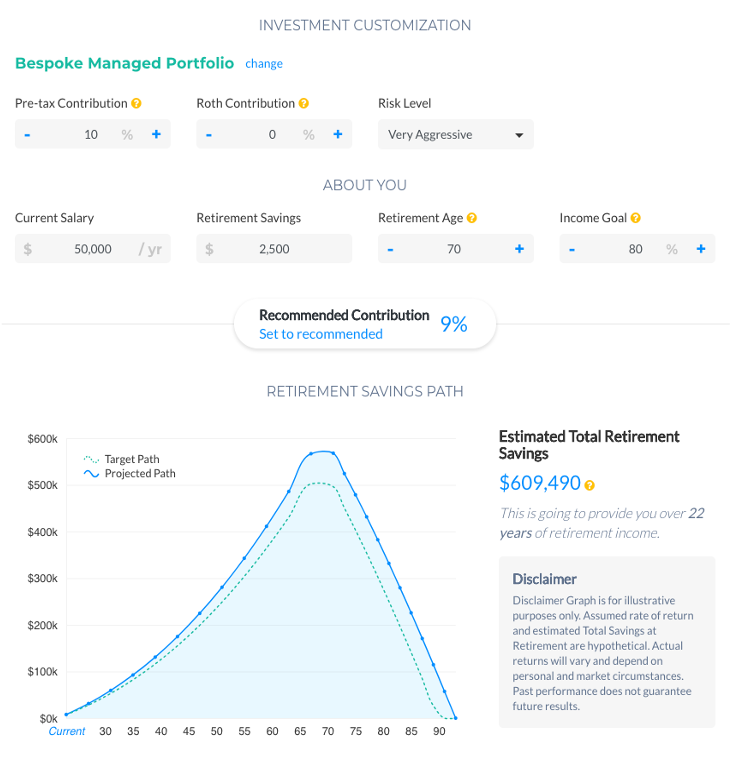

What is the Bespoke Portfolio Service?

The Bespoke Portfolio Service is a new investing tool created and provided by Slavic401k. Bespoke is one of the first digital advisors built into a 401(k) platform. It uses a proprietary algorithm to custom-craft a retirement savings and investing plan unique to your goals and life circumstances. It is a fully integrated digital advisor that helps make retirement readiness a reality.

How does Bespoke work?

Bespoke factors in your age and expected timeline to retirement and recommends how much to save and how to escalate your savings rate over time to reach your goals. It provides a reasonable retirement savings target and shows a clear path to reaching that target. Bespoke creates a custom retirement portfolio allocation, considering appropriate risk exposure and providing the balance of potential gain and portfolio stability. Additionally, Bespoke intelligently re-allocates your portfolio to become more conservative over time.

You can access and enroll in Bespoke Services by selecting the “Bespoke” menu item from the 401k portal.

Why should I enroll in Bespoke?

Bespoke provides expert financial advice through a fully automated and digital platform. You don’t have to become an expert investor or pay expensive fees to get advice from a human financial advisor. Bespoke provides a clear and straightforward path to setting and reaching your retirement goals.

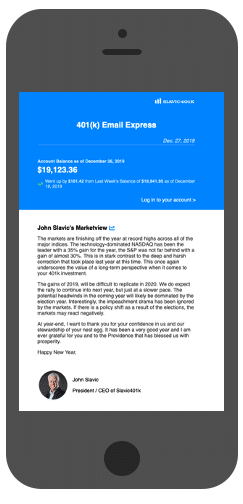

Keep an eye on your 401(k) investment with Email Express

You have the option of receiving an “Email Express” email that provides your 401(k) balance once a week.

When it comes to your 401(k) plan, knowledge is power.

Our Email Express™ program provides participants with weekly insights into the status of their individual account, as well as critical updates on market fluctuations and the direct impact those changes may have on your plan.

Weekly updates include:

- Brief Market Commentary

- 401(k) Account Balance

- Previous Week 401(k) Account Balance

Once you meet your employers waiting period, you can enroll in the 401(k) program, you will enter the program on the 1st day of the next calendar quarter. Every employer defines their own waiting period. If you have questions about your particular waiting period, please feel free to open a support ticket. A benefit specialist will research and respond right away.

Plan entry dates are as follows:

- January 1

- April 1

- July 1

- October 1

For example, if you enroll in the 401(k) plan on January 20th, your deductions will start to take place the payroll immediately dated after April 1st, the start of the next calendar quarter.

AdvanStaff HR has licensed advisors on staff to help with initial onboarding, enrollment, and many other functions.

When it comes to most account services, we recommend contacting the Slavic employee service team. The Slavic team has special access to your account and can help with nearly all requests.

Slavic401k Customer Service (800) 356-3009

Live customer service staff is available to assist, Monday through Friday

8:00 am to 8:00 pm EST