OSHA COVID-19 Log Requirements For Healthcare Providers Offices Still In Effect

OSHA COVID-19 Log Requirements For Medical Offices Still In Effect On Dec 27, OSHA announced that it intends to continue to work expeditiously to issue a final standard that will protect healthcare workers from COVID-19 hazards, and will do so as it also considers its broader infectious disease rulemaking. OSHA also announced it is withdrawing […]

IRS 401(k) Limits for 2022

IRS 401(k) Limits for 2022 New IRS 401(k) Limits for 2022* The elective deferral limit for 401(k), 403(b) and 457(b) plans increases to $20,500 in 2022 ($19,500 in 2021). The limitation on catch up contributions for employees age 50 and over is $6,500 in 2022. *Source: https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-401k-and-profit-sharing-plan-contribution-limits

IRS Announces 2022 Standard Mileage Rates

On Dec. 17, 2021, the IRS announced the 2022 optional standard mileage

rates.

Preparing for an OSHA Visit

This resource offers considerations and guidelines to assist in minimizing the likelihood of an OSHA warning or fine.

OSHAs Top 10 Most Frequently Cited Standards for 2021

The top 10 OSHA standards cited in fiscal year 2021 and the total number of violations for each standard.

2022 National Safety Observances Calendar

Use this calendar throughout 2022 to track national safety observances and learn about important workplace topics.

New Affirmative Action Plan (AAP) Certification Compliance Requirements for Federal Contractors

New Compliance Requirements for Federal Contractors Affirmative Action Plan (AAP) Certification Starting in 2022, federal contractors and subcontractors who hold a contract of at least $50,000 and have 50 or more employees will need to provide certification of their AAPs to the Office of Federal Contract Compliance Programs (OFCCP) via the AAP-VI portal. Important reporting […]

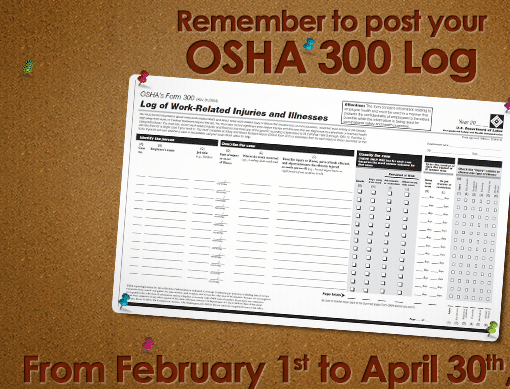

The Federally Required OSHA 300A Summary Posting is Due Feb 1

[vc_row][vc_column][vc_column_text]What: OSHA 300A Summary of serious work-related injuries & illnessesWhen: Post from February 1 thru April 30, 2019 for the prior year’s dataWhy: As required by OSHA for record keepingWho: Employers with more than 10 employees*How: Simply, print, sign & post the summary report alongside your other required workplace notices.Where: Each worksite location NEXT STEPSAs a courtesy, our Risk Management department has recently emailed the OSHA […]

IRS 401(k) Limits for 2019*

New IRS 401(k) Limits for 2019* The elective deferral limit for 401(k), 403(b) and 457(b) plans increases to $19,000 in 2019 ($18,500 in 2018). The limitation on catch up contributions for employees age 50 and over remains at $6,000 in 2019. The maximum “annual addition” limit for a defined contribution plan increases to $56,000 in 2019 ($55,000 in 2018). The annual […]

Form I-9 Policy Change effective Jan 1, 2019

Since inception, AdvanStaff HR has assisted every client employer with Form I-9 compliance and meeting federal obligations under the USCIS (U.S. Citizenship and Immigration Services) regulations. This notice clarifies a procedural and administrative change to the existing Form I-9 completion and administration process. Section 1 of the Form I-9 must be completed by EVERY employee no later than […]