-

Employee Info Center

- How does a new hire employee begin paperless onboarding ?

- Training Tutorials and Demonstrations - Employee

-

- Welcome Employees

- What Does AdvanStaff HR Do For You?

- Payroll & Benefits Onboarding

- Employee Portal (ESS)

- Employee Mobile App

- Understanding Your Employee Benefits

- Employee Training & Informative Videos

- Report a workplace injury

- Report a workplace concern

- How does a new hire employee begin paperless onboarding ?

-

- Employee Handbooks

- What are your office hours?

- Account Security & Multi-Factor Authentication (MFA)

- Email Address Requirements

- What is the status of my job application?

- Employment & Salary Verifications

- How does a new hire employee begin paperless onboarding ?

- Employee Support

-

- I forgot my web username, can I reset it?

- How do I reset my web password?

- What is an Account Access Confirmation?

- Employee Self-Service Portal Access

- Why can't I get my SECURITY CODE for Employee Self Service Account Access?

- Employee Portal (ESS)

- How do I disable pop-up blockers?

- Employee Social Security Number (SSN) Edits

- How does a new hire employee begin paperless onboarding ?

-

- All Benefits & Perks

- Understanding Your Employee Benefits

- How To Save On Medical costs

- Open Enrollment

- Qualifying Life Event (QLE)

- Why isn't the benefit enrollment portal opening for me in the Employee Portal?

- Who can I add as a dependent for my benefit coverage?

- Benefit Basics Video

- Annual Plan Contribution Limits

-

- Group Dental Insurance (UHC)

- Group Vision Insurance (UHC)

- Group & Voluntary Life Insurance Coverage for Dependents (MetLife)

- Voluntary Health: Physician, Urgent Care, Hospital, Dental, Vision, and Wellness Benefits, Inpatient, $0 Telemed (Hooray Health)

- WellCall360 - Voluntary Wellness + 0$ Tele-med, Rx, Dental, Vision (Hooray Health)

- Instant Decision, Affordable Life Insurance

- Whole Life Insurance with Long-Term Care

-

- Voluntary Health: Physician, Urgent Care, Hospital, Dental, Vision, and Wellness Benefits, Inpatient, $0 Telemed (Hooray Health)

- WellCall360 - Voluntary Wellness + 0$ Tele-med, Rx, Dental, Vision (Hooray Health)

- MetLaw Legal Plans

- MyPetProtection Insurance

- Accident Insurance (MetLife)

- Hospital Indemnity Insurance (MetLife)

- Critical Illness Insurance (MetLife)

- Short-term and Long-term Disability Insurance (MetLife)

- Group & Voluntary Life Insurance Coverage for Dependents (MetLife)

- Instant Decision, Affordable Life Insurance

- Voluntary Benefit Programs

- Whole Life Insurance with Long-Term Care

-

- Annual Plan Contribution Limits

- Flex Spending Accounts

- Medical Expense FSA

- Premium Only Plan FSA

- Dependent Care FSA

- Commuter, transit, and parking FSA

- Health Savings Accounts (HSA)

- Limited Purpose Flex Spending Account (LPFSA)

- FSA - Member Portal (year 2020 and previous)

- How To Save On Medical costs

-

Manager Info Center

-

- Employee Onboarding

- 401k Retirement Plan Services

- Employment & Salary Verifications

- Leave Requests: PTO Tracking & Approvals

- Employee Earned Wage Access (EWA)

- Corporate & Personal Travel Deals You Can't Find Anywhere Else

- Document Management System (DMS)

- Workers Compensation Program and Policy Administration

-

- Learning Management System (LMS)

- Performance Management (PM)

- Background and Drug Testing

- Applicant Tracking System (ATS)

- Short-term Payroll Funding

- R&D Tax Credit (R&D)

- Work Opportunity Tax Credit (WOTC)

- Employee Portal Messaging-Alerts

- Business Insurance

- Labor Poster Compliance Solutions for Local and Remote Workers

-

- Full-Service Payroll & Employment Tax Administration

- Time Keeping Solutions Introduction

- New Hire Payroll Onboarding

- Workers Compensation Program and Policy Administration

- Labor Poster Compliance Solutions for Local and Remote Workers

- Employee Handbook Program (Core+)

- FMLA Compliance

- Affordable Care Act (ACA) Compliance

- Workplace Safety Program Assistance

- HR Toolkit

-

- Full-Service Payroll & Employment Tax Administration

- Submitting Payroll Hours, Salary, Commissions, etc.

- Payroll Timesheet Imports

- Minimum Wage Map

- Direct Deposit

- Employee Earned Wage Access (EWA)

- Pre-paid VISA Paycard

- Employment & Salary Verifications

- Office Schedule, Payroll Processing Cutoff Dates, Federal Reserve Bank Holidays, System Maintenance Schedule

-

- Employee Benefit Plan Administration

- All Benefits & Perks

- Flex Spending Accounts

- 401k Retirement Plan Services

- Employee Assistance, Wellness, and Lifestyle Programs (EAP)

- Affordable Care Act (ACA) Compliance

- Group & Voluntary Life Insurance Coverage for Dependents (MetLife)

- Voluntary Benefit Programs

-

- Workers Compensation Program and Policy Administration

- Claims Management and Administration Assistance

- Workplace Safety Program Assistance

- Report a workplace injury

- Report a workplace concern

- WC CLAIMS FORMS BY STATE

- Employment Practice Liability Insurance (EPLI)

- Secure Upload Documents

- Business Insurance

-

- Employee Record Maintenance in the Manager Portal

- Manager Training Video Library

- Document Management System (DMS)

- Employee Portal Messaging-Alerts

- Employee Portal Event Management

- Manager Portal Training - The Basics

- I-9 Part 2 Approval Guide

- Training Support in the Manager Portal

- Employee Social Security Number (SSN) Edits

- Training Tutorials and Demonstrations - Worksite Managers and Administrators

Voluntary Health: Physician, Urgent Care, Hospital, Dental, Vision, and Wellness Benefits, Inpatient, $0 Telemed (Hooray Health)

Voluntary Health & Wellness

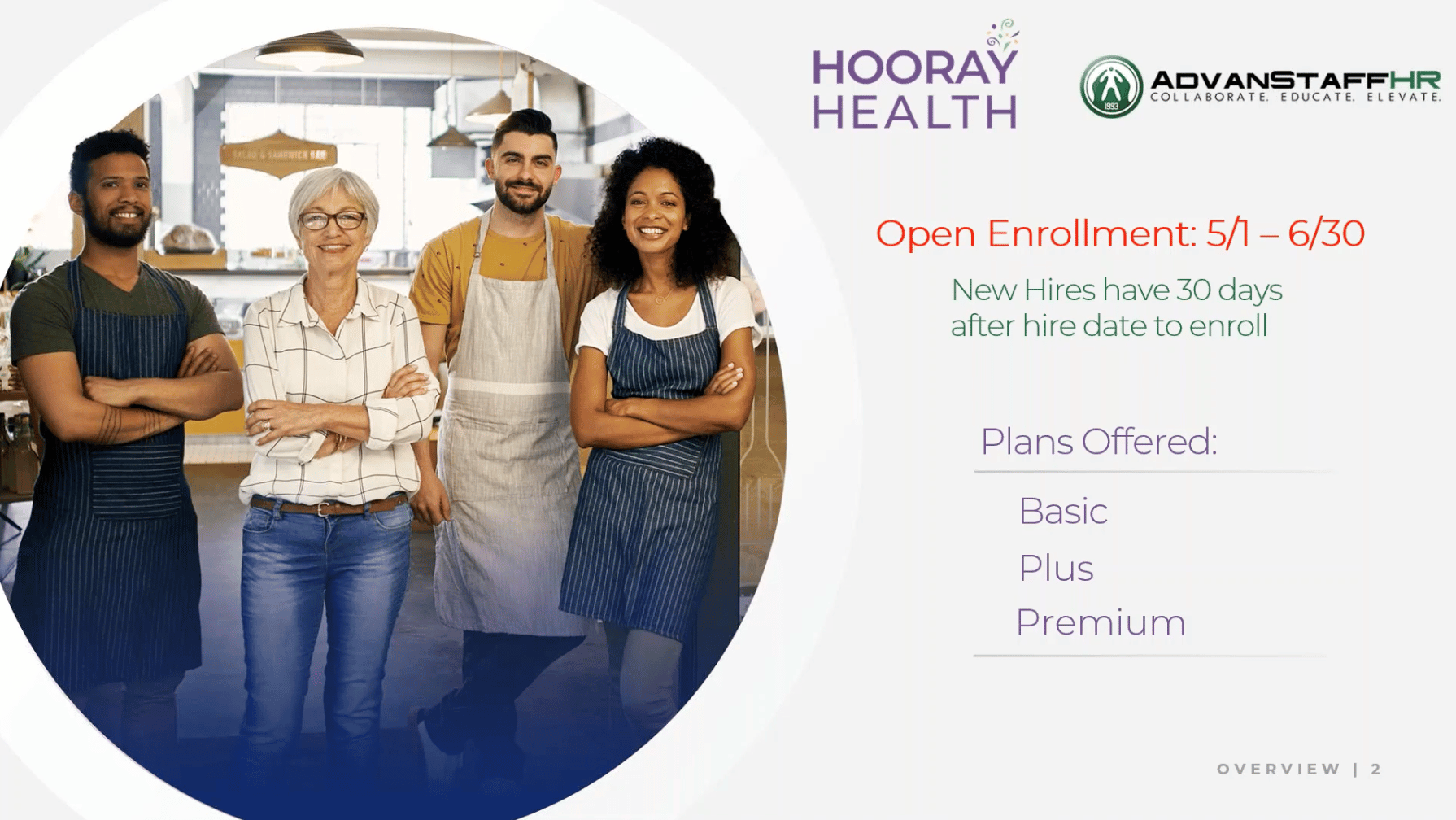

Benefit Options For Employees

Voluntary Health: $25 Copay Retail Clinic and Urgent Care visits, Physician visits, Imaging and Lab tests, Inpatient Hosp Benefits, $0 Telemed

A new type of health and wellness benefit has arrived!

Employees who are not eligible for employer sponsored benefit programs can now take control of their health and wellness programs with voluntary, employee-paid programs offered by Advanstaff HR.

Finally an affordable plan option for small to medium health care costs.

The Hooray Health Basic, Plus, and Premium plans include in-network Urgent Care and Retail Clinic visits, First Health Network Specialty Providers, unlimited tele-med doctor visits, behavioral health consults, discount Rx, dental & vision benefits, and more. At open enrollment or at time of hire, employees can voluntarily choose between three levels of health plans.

Premiums are paid via payroll deductions and your member benefits can all be managed through the carrier app.

Premiums paid are “flexed” through the Premium Only Plan (POP) FSA which means you are not paying income taxes on this premium. This awesome benefit effectively LOWERS the real cost of the plan versus paying to carrier directly.

An example on how payroll deduction premium payment saves you money:

Mike participates in this plan for employee only coverage. The cost is $90 / month directly deducted from his paycheck ($45 each paycheck). Because Mike is in the 15% tax bracket, Mike now SAVES $13.50 per month on taxes which in effect lowers the overall cost of the premium.

Choose From Three Levels Of Coverage

Basic Plan

Gives members access to treatment for their basic medical needs in a cost-effective manner.

Plus Plan

Includes additional benefits for in-hospital

care. Fixed reimbursement amounts are paid on covered procedures.

Premium Plan

Offers increased coverage reimbursements on permitted treatments and services.

All plans include:

Everyone has unique needs. Members can choose their coverage and benefit level. In addition to the three base tiers, add-on benefits can also be selected.

Unlimited Tele-med Services

- Members can talk to doctor 24/7 with a $0 consult fee. This is an unlimited benefit.

Behavioral Health Plan Coverage

- Now more than ever, behavioral health counseling is a crucial aspect of your well-being since 75% of the population experiences “some stress” every two weeks.

- You’ll have access to telephonic Counseling services without an “out of pocket” expense with 100% follow-up with the original counselor.

Dental Plan Coverage

- Grants you the convenience of quality dental coverage at a cost that suits their budget.

Vision Plan Coverage

- Offering you access to high quality vision insurance at a price that doesn’t break the bank.

Benefit Examples:

- $0 consult fee for 24/7 Telemedicine Services (unlimited)

- $25 copay and no surprise bill for retail clinic and urgent care network

- Discounts on prescription medication

- 24/7 access to Member Services and Medical Concierge

- Mobile app

Frequently Asked Questions (FAQs)

The most common questions for this benefit programs are listed below.

Please feel free to contact our benefits department by either calling 702-598-0000 or by submitting a support ticket HERE. A benefit specialist will respond promptly.

This voluntary program is available to:

- Part-time employees

- Full-time employees whose employer does not offer or sponsor an employee health program.

This program does NOT replace employer sponsored programs offered to full-time employees. If you are a full-time employee and have access to an employer-sponsored plan, then you should participate in that plan. The voluntary plans purpose is not to replace your insurance program.

If your employer sponsors and pays (or partially pays) for a bonafide employee health benefit program, then you are not eligible for this voluntary program.

Enrollment takes place within 30 days of your date of hire or during annual open enrollment. Coverage always begins on the 1st day of the next month following enrollment. The carrier does not all partial month enrollments.

Open enrollment is generally in May 1 – June 30 each year.

During open enrollment or within 30 days of being hired, employees have several ways to enroll:

- via the employee portal using a web browser, tablet, or mobile device. Click on “Benefits Enrollment”

- via the AdvanStaff HR Apple or Android Mobile App.

If you would like to enroll and don’t see the option when viewing your employee portal account, please contact the AdvanStaff HR Benefits Department.

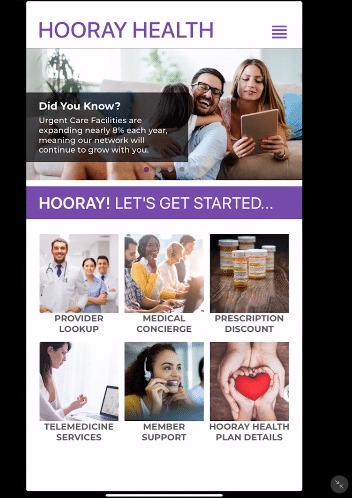

A few days after enrollment, you can access your benefits using the state-of-the-art carrier mobile app.

The Hooray Health’s mobile app puts state-of-the-art care in the palm of your hand with

- quick, searchable access to providers and prescription savings when and where needed.

- Provider Locator

- Telemedicine Services

- Prescription Discounts

- Member Support

- Medical Concierge

It’s never been easier to access your benefits at any time.

Examples of benefits included in all plans are:

- Unlimited tele-med doctor visits

- Live doctor office visits (limited based on plan)

- Discount dental coverage

- Discount vision coverage

- Discount mental health and wellness coverage

- Discount prescription (Rx) coverage

- Accident and hospital indemnity coverage (limited, depending on plan.

Benefits are easily accessed and managed using the Hooray Health mobile app.

A member will pay a $25 copay at a retail clinic or urgent care center that is in the Hooray Health network. The member will not receive a balance bill or additional charges for covered procedures at in-network providers.

Hooray Health Benefit Plans are an affordable, accessible, and simple healthcare solution.

Hooray Health Benefit Plans are categorized as fixed indemnity and accident insurance plans. The insurance company pays, on the fixed indemnity policy, a predetermined amount on a per-period or per-incident basis, regardless of the total charges incurred. On the accident policy, approved charges are reimbursed up to the policy limit.

Members on the:

- Basic Plan receive 3 visits per year for injuries and illnesses.

- Plus Plan receives 4 visits per year for injuries and illnesses.

- Premium Plans offer 5 visits per year for injuries and illnesses.

Member’s cost is $0 per consultation for telemedicine services.

The service is available to members 24/7/365 for an unlimited number of consults per year. Members can speak to a physician at their convenience, and if needed, their prescriptions can be called into a pharmacy of their choice.

Use the Hooray Health app to compare prescription drug prices at local pharmacies.

Eligible employees may enroll at any time within the first 30 days of employment.

All other eligible employees may enroll in benefits during the company’s selected enrollment period. Benefits will be effective the first of the month following enrollment.

Yes. However, they’ll not be eligible for the plan again until the next Open Enrollment or during a qualifying life event.

Open Enrollment is from December 1 to December 23 for your Eligibility starting January.

No. These voluntary plans are not ACA compliant and do not replace the primary offering an employer may offer.

These plans are designed to be an alternative, low cost health and wellness option that provides basic access to doctor consultations, lower cost prescriptions, a basic hospital and injury indemnity, basic dental, basic vision coverage. They are not designed to replace bonafide group insurance offered by your employer.

Part-time employees are eligible to opt-in to coverage on a voluntary basis.

Employees (part-time or full-time) who do not have access or can’t afford the employer offered plan should consider this plan as an alternative.

The benefits on this plan are lower than fully-insured, ACA compliant health programs. Please review the benefit statement below for additional details.

Yes! Regardless of full-time or part-time employee status, premiums payments deducted directly from your pay check ARE flexed. This is a huge benefits and lowers the overall cost of this program vs buying outside of your employer.

Premiums paid are “flexed” through the Premium Only Plan (POP) FSA which means you are not paying income taxes on these premium deductions. This awesome benefit effectively LOWERS the real cost of the the plan versus paying to carrier directly.

An example on how payroll deduction premium payment saves you money: Mike participates in this plan for employee only coverage. The cost is $90 / month directly deducted from his paycheck ($45 each paycheck). Because Mike is in the 15% tax bracket, Mike now SAVES $13.50 per month on taxes which in effect lowers the overall cost of the premium.